Renters Insurance in and around Sedona

Looking for renters insurance in Sedona?

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

- Clarkdale

- Cornville

- City of Sedona

- Rimrock

- Camp Verde

- Munds Park

- Strawberry

- Village of Oak Creek

- Cottonwood

- Jerome

- Yavapai County

- Coconino County

Insure What You Own While You Lease A Home

It's not just the structure that makes the home, it's also what's inside. So, even if your home is a rented townhouse or condo, renters insurance can be the right next step to protect your personal items, including your boots, coffee maker, golf clubs, TV, and more.

Looking for renters insurance in Sedona?

Renters insurance can help protect your belongings

There's No Place Like Home

When renting makes the most sense for you, State Farm can help cover what you do own. State Farm agent Andrew Bailor can help you with a plan for when the unpredictable, like a water leak or a fire, affects your personal belongings.

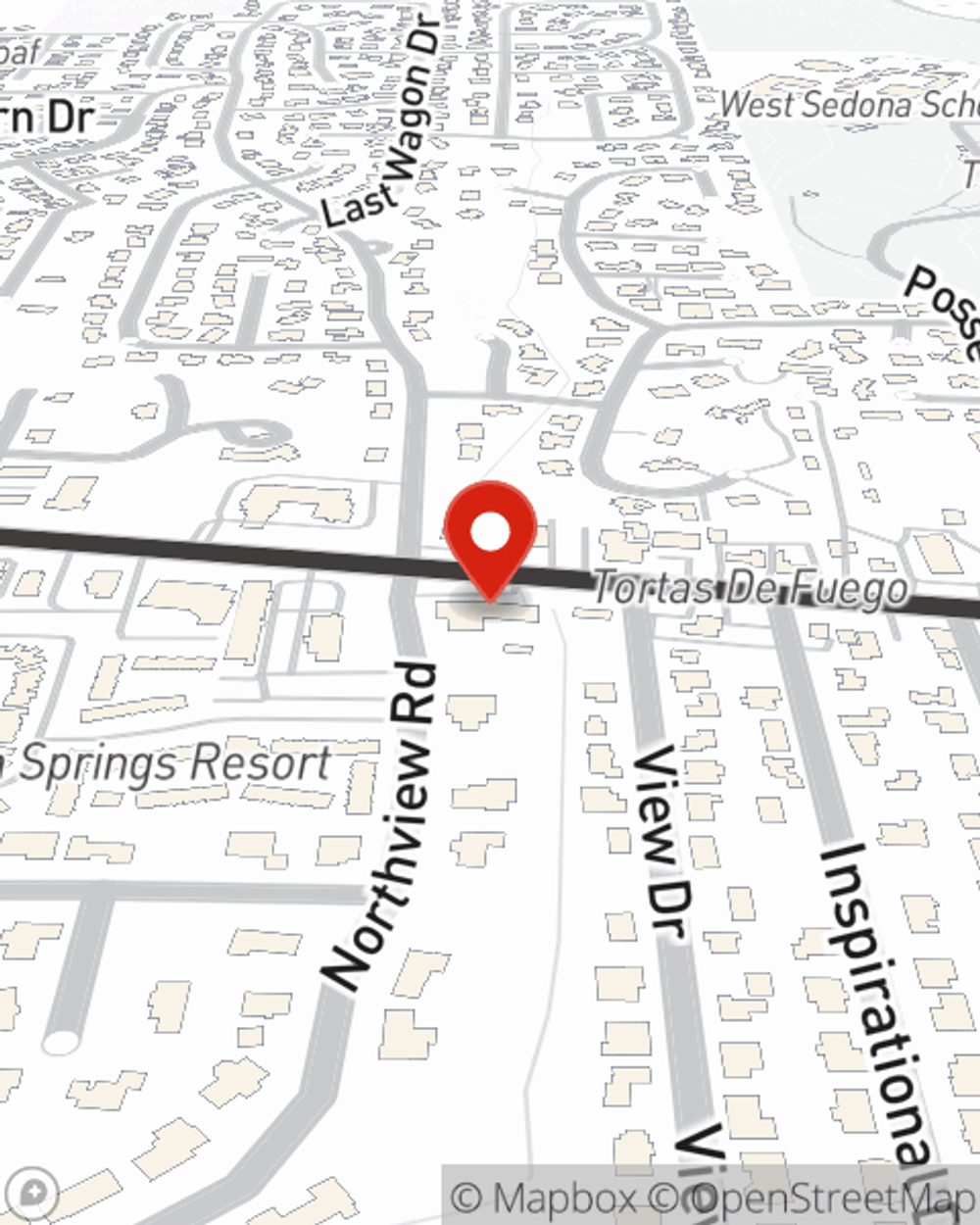

More renters choose State Farm® for their renters insurance over any other insurer. Sedona renters, are you ready to learn how you can protect your belongings with renters insurance? Visit State Farm Agent Andrew Bailor today to see what State Farm can do for you.

Have More Questions About Renters Insurance?

Call Andrew at (928) 282-1242 or visit our FAQ page.

Simple Insights®

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.

Andrew Bailor

State Farm® Insurance AgentSimple Insights®

Questions to ask your insurance agent

Questions to ask your insurance agent

Insurance needs are ever-changing. Here are some questions to ask an insurance agent to start the conversation and further explore your coverage options.

How to get rid of bed bugs

How to get rid of bed bugs

Learn about potential ways to spot bed bugs and what you can do to get rid of them before they spread throughout your home.